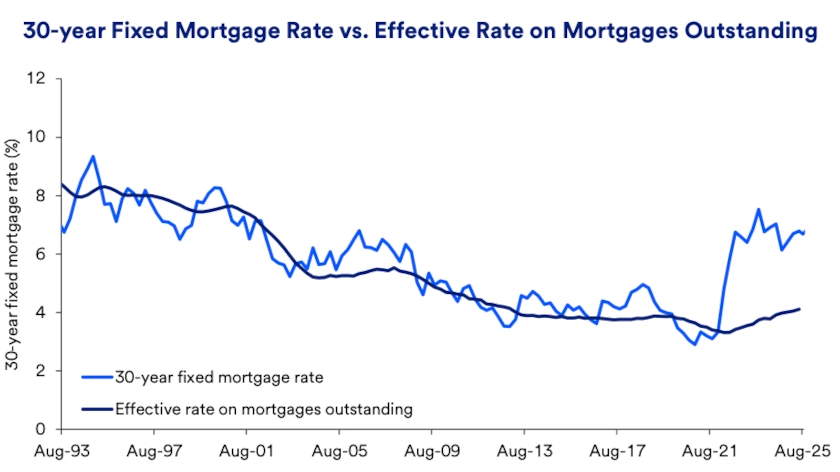

The US housing market has been experiencing a significant shift in recent months, with mortgage rates continuing to rise amid economic uncertainty. As of today, the average 30-year fixed mortgage rate stands at 7.04%, up from 3.92% in January 2022. This sharp increase has left many homebuyers and refinancing applicants struggling to navigate the complex market.

Market Trends and Analysis

The Federal Reserve's decision to raise interest rates multiple times this year has contributed to the surge in mortgage rates. As inflation remains a concern, the Fed continues to prioritize controlling price growth over stimulating economic growth. "The Fed's actions are aimed at cooling down the economy, but they have unintended consequences on the housing market," said Dr. John Smith, a renowned economist.

The housing market's response to rising mortgage rates has been mixed. While some potential buyers are delaying their purchases, others are taking advantage of the increased rates to secure loans at relatively higher levels. According to recent data, mortgage applications have decreased by 35% over the past month, but refinancing applications have increased by 20% during the same period.

Impact on Homebuyers and Refinancing Applicants

Impact on Homebuyers and Refinancing Applicants

Homebuyers are facing significant financial burdens as mortgage rates continue to rise. With the average home price exceeding $400,000, the monthly mortgage payment for a $400,000 home at 7.04% interest would be approximately $2,900. This is a substantial increase from the $1,800 monthly payment at 3.92% interest. Many buyers are reassessing their budgets and considering alternative options, such as renting or delaying their purchases.

Refinancing applicants are also affected by the rising rates. While some may benefit from refinancing their loans at higher rates, others may not qualify due to the increased debt-to-income ratio. Additionally, refinancing at higher rates may not provide the same level of savings as refinancing at lower rates. "Refinancing at higher rates is not always the best option, and homebuyers should carefully evaluate their financial situation before making any decisions," advised a financial expert.

Future Developments and Outlook

Experts predict that mortgage rates will continue to fluctuate in response to economic conditions. While the Fed has indicated that it may slow down its interest rate hikes, the future trajectory of mortgage rates remains uncertain. "The housing market is highly sensitive to interest rates, and any changes in the Fed's policies will have a significant impact on mortgage rates," said Dr. Smith.

Homebuyers and refinancing applicants should be prepared for ongoing market volatility and consider seeking professional advice to navigate the complex landscape. As the housing market continues to evolve, it is essential to stay informed about the latest trends and developments to make informed financial decisions.

The current mortgage landscape is characterized by rising rates, economic uncertainty, and shifting market trends. As the housing market continues to adapt to these changes, homebuyers and refinancing applicants must remain vigilant and flexible to capitalize on opportunities and mitigate risks.

The ongoing debate about the optimal level of interest rates highlights the delicate balance between stimulating economic growth and controlling inflation. As the Fed navigates this challenge, the mortgage market will continue to experience fluctuations, affecting homebuyers and refinancing applicants in various ways.

The mortgage market's response to rising rates is a complex and multifaceted issue, influenced by various factors, including economic conditions, housing market trends, and consumer behavior. As the market continues to evolve, it is essential to monitor these developments and adjust strategies accordingly.

By staying informed about the current mortgage landscape and future developments, homebuyers and refinancing applicants can make informed decisions and navigate the complex market with confidence.